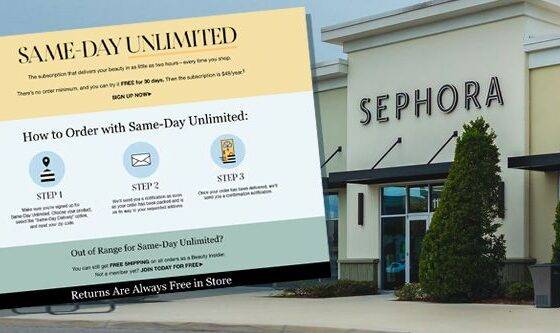

What metrics are important to a subscription business?

Yes, you have to measure some notable ones like LTV, CAC, Churn rate, MRR, payback period, etc. But, there are plenty of other metrics that a subscription business can track, depending on the model and…

read more