This year, clients are obsessed with fixing “churn” – proactively trying to stop customers from canceling.

There are two types:

Voluntary churn: Customers choose to end their subscription.

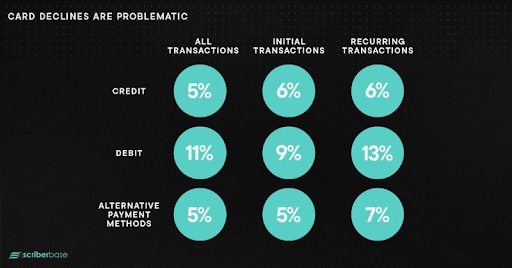

Involuntary churn: Customers lose access due to failed payment.

Involuntary churn accounts for ~40% of a business’s total churn rate.

Expired cards, technical glitches, insufficient funds, etc.

It’s a problem that significantly impacts revenue capture.

But, it can be fixed.

Solutions:

Optimize Payment Processing:

↳ Offer a variety of payment options and use a reliable payment gateway.

Proactive Card Updating:

↳ Implement services that automatically update expired card details.

Smart Retry Strategies:

↳ Use technology to identify patterns in payment failures and optimize retry timing.

Effective Dunning Management:

↳ Communicate clearly with customers about failed payments and offer flexible solutions.

Seamless Customer Experience:

↳ Make it easy for customers to manage their payments.

Remember, churn is both a ‘customer service’ and a ‘payments’ problem.

Don’t just address one side of the coin.