Wrong.

While voluntary churn (customers leaving by choice) is tough to avoid, involuntary churn is preventable.

Involuntary churn happens when payments fail—due to expired cards, insufficient funds, or outdated billing info.

The result? You lose customers who want to stay.

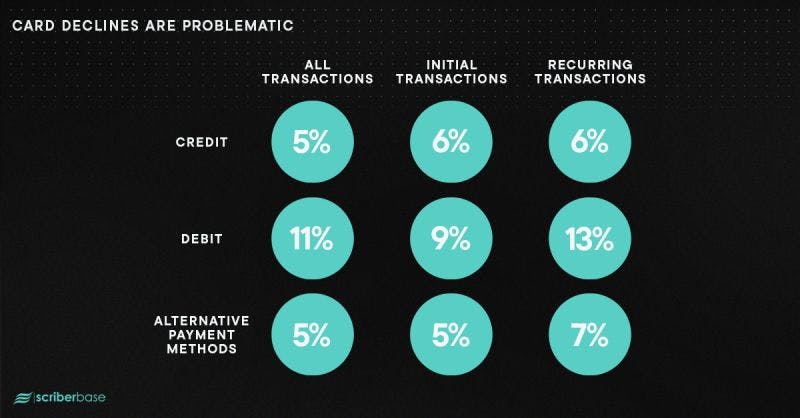

Here’s the reality:

13% of debit transactions fail.

6% of credit card payments fail.

7% of alternative methods fail.

These customers aren’t unhappy. They just couldn’t pay you.

Here’s how you fix it:

Credit card updater tools

Automatic payment retries

Dunning software and process

Every failed transaction is lost revenue.

Understand where your payments are failing.

Fix the leak, and you’ll grab up to 20% more revenue.

Retention is Revenue

Churn is now a boardroom problem. If you’re in the