Consider this:

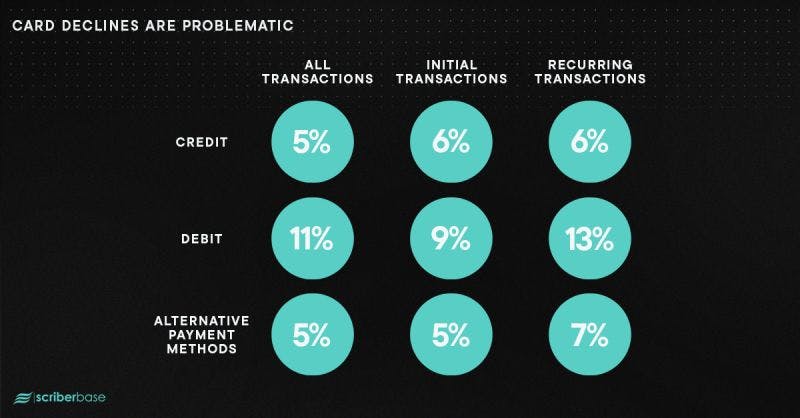

→ Credit card declines affect 5-6% of all transactions.

→ Debit card declines? Higher, at 9-13%.

→ Alternative payment methods fail 7% of the time.

For subscription-based businesses, these numbers translate directly to lost revenue.

Involuntary churn—when customers unintentionally fail to renew due to payment issues—is problematic for most recurring revenue businesses as they scale.

A significant portion of these declines is preventable.

To combat involuntary churn:

◆ Ensure your billing descriptors are 100% accurate.

◆ Leverage automatic credit card updaters.

◆ Implement retry logic to recover failed payments.

◆ Notify customers when payment issues arise (dunning).

◆ Expand your range of alternative payment methods.

Involuntary churn accounts for up to 50% of your overall churn rate.

So, don’t just focus on the customer service side of things.

Fix the payments side too.

Hope this helps!

Retention is Revenue

Churn is now a boardroom problem. If you’re in the